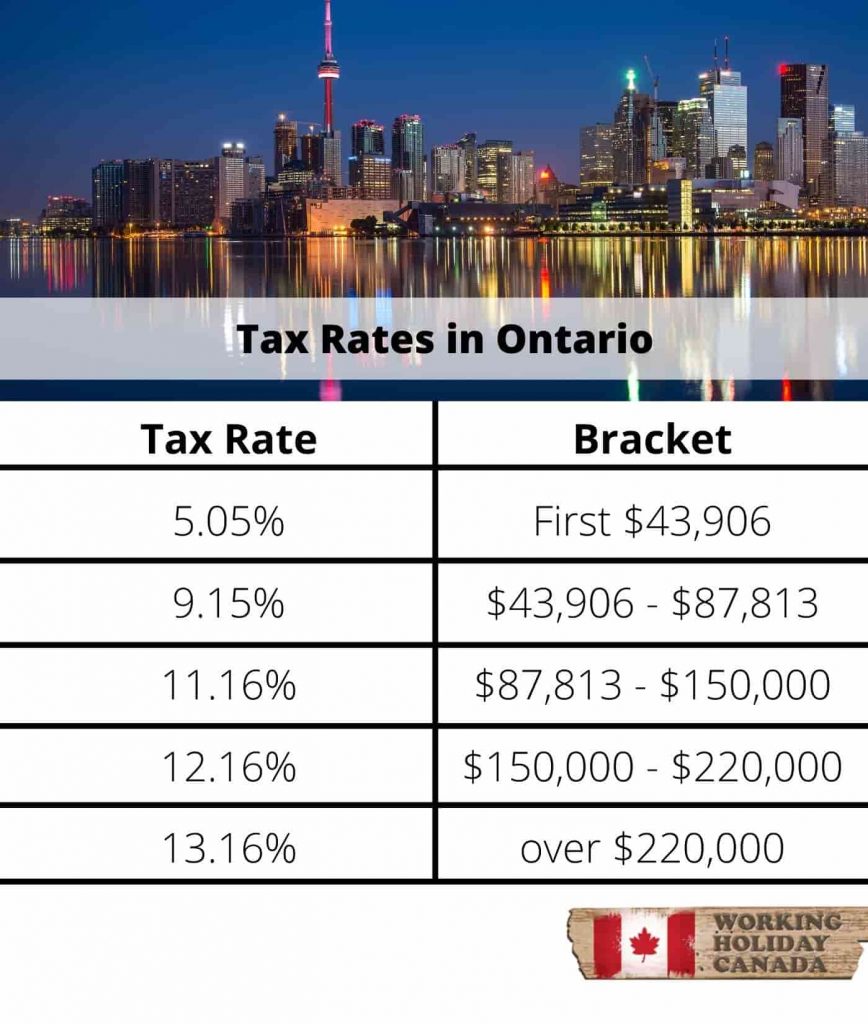

Income Tax Brackets 2025 Ontario. The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except for the $150,000 and $220,000 bracket amounts, which are not. Forbes advisor canada has a tool to help you figure it out.

Personal income tax is collected annually from ontario residents and those who earned income in the province.

Ontario Tax Brackets 2025 What They Are and How They Affect, Tax brackets and other amounts have been indexed by 4.5% to recognize the impact of. Forbes advisor canada has a tool to help you figure it out.

Tax Information Every US Citizen Working In Canada Must Know, It’s not just federal taxes you need to think about. High interest rates are expected to continue negatively impacting ontario’s economy in 2025, with real gross domestic product (gdp) growth projected to slow from.

The Handy Tax Deductions Checklist To Help You Maximize Your, The amount of tax your employer deducts from your paycheque varies based on where you fall inside the federal and ontario tax brackets. With the exception of the cad 150,000 and cad 220,000 bracket stages, which aren’t indexed for inflation, the ontario tax brackets and private tax credit score.

Tax Information Every US citizen Working in Canada Must Know, High interest rates are expected to continue negatively impacting ontario’s economy in 2025, with real gross domestic product (gdp) growth projected to slow from. It’s not just federal taxes you need to think about.

Minimum Tax Bracket Canada Are you ready? — Greater Fool Authored, If you make $60,000 a. With the exception of the cad 150,000 and cad 220,000 bracket stages, which aren’t indexed for inflation, the ontario tax brackets and private tax credit score.

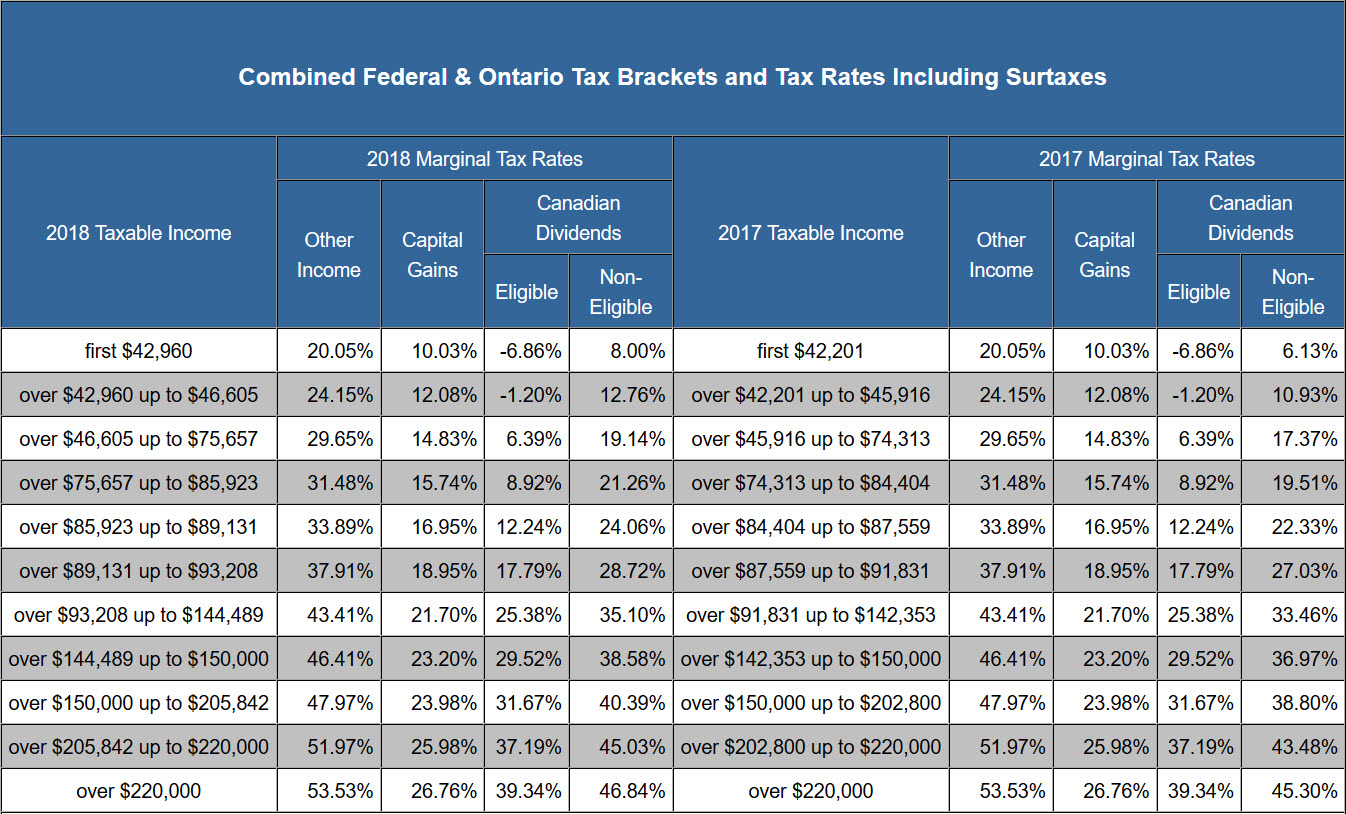

personal tax rate 2018 Joanne Walsh, The ontario tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.045 (4.5% increase), except for the $150,000 and $220,000 bracket amounts, which are not. 2025 ontario income tax brackets 2025 ontario income tax rate;

Canada Vs Usa Tax Brackets A Comparison In 2025, Over $102,894 up to $150,000:. If you make $60,000 a.

75,000 After Tax in Ontario How Much Do You Have to Earn to Bring, High interest rates are expected to continue negatively impacting ontario’s economy in 2025, with real gross domestic product (gdp) growth projected to slow from. Tax brackets are indexed and adjusted based on the consumer price index each year, and tax rates are the percentage of their income people pay to regional and.

Tax Rates 2025 To 2025 2025 Printable Calendar, Understanding ontario tax brackets 2025. Over $51,446 up to $102,894:

2025 Tax Brackets Calculator Nedi Lorianne, Select your tax residence status: If you make $60,000 a.